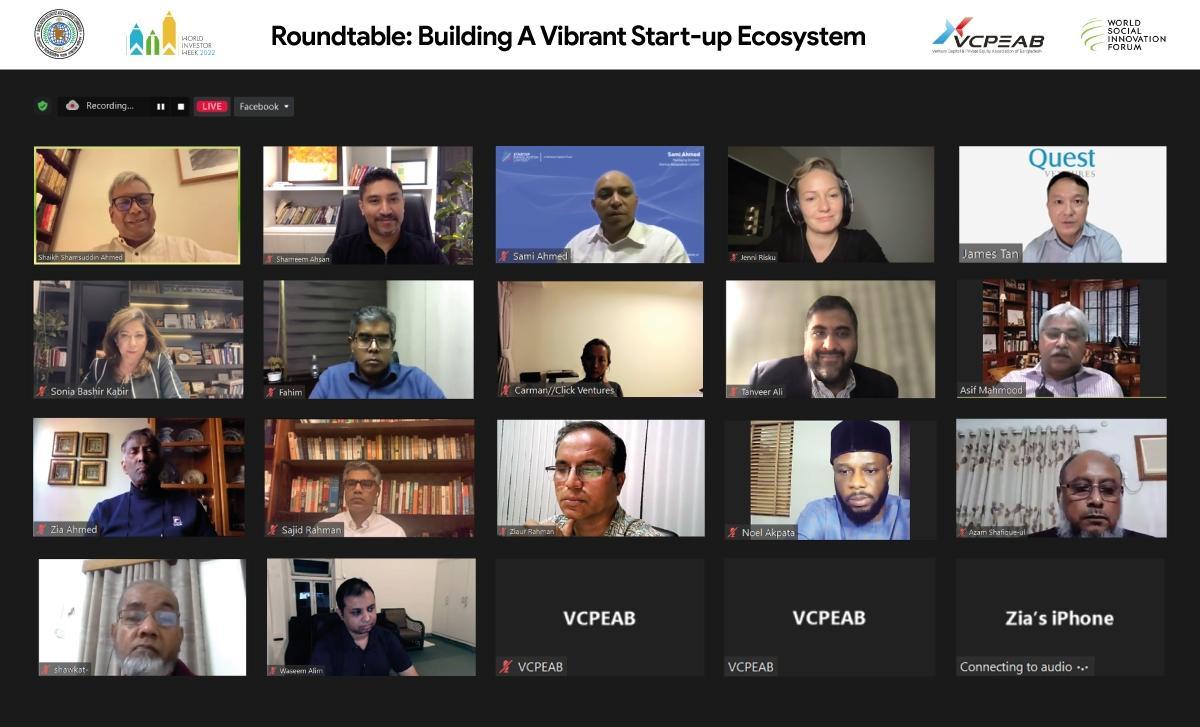

Bangladesh Securities and Exchange Commission (BSEC), Venture Capital & Private Equity Association of Bangladesh (VCPEAB) and World Social Innovation Forum (WSIF) organized a roundtable titled “Building A Vibrant Startup Ecosystem” to celebrate World Investor Week 2022 which is a week-long, global campaign promoted by International Organization of Securities Commission (IOSCO). The roundtable discussed the required improvements or changes in current rules/regulations/provisions for

ameliorating to a better and stronger Start-up Ecosystem. Speakers also discussed about the vision to create five Unicorns by 2025.

Bangladesh’s startup ecosystem is heating up, but still facing challenges. Currently, Bangladesh has 1,200 active startups creating drastic impacts in day-to-day Bangladeshi lives through new, innovative products and services. The country has attracted a total investment of USD 505 Mn in 2021 and 2022 (up to quarter 2), with a total contribution of USD 498 Mn from global investors. Though Bangladesh’s position as a maturing startup hotspot has started grabbing international attention, the support for startups needs to evolve. Some improvements or changes in current rules/regulations/provisions can bring development to a better and stronger industry.

In the roundtable, Dr. Shaikh Shamsuddin Ahmed, Commissioner, BSEC attended as the special Guest. The keynote presentation was delivered by James Tan, Managing Partner of Quest Venture and Tanveer Ali, Chief Investment Officer of Constellation Asset Management Company Ltd B; Director of VCPEAB. The moderator of the session was Asif Mahmood, Vice President of VCPEAB, Managing Partner of SEAF Bangladesh Ventures.

Dr. Shaikh Shamsuddin Ahmed, BSEC Commissioner, BSEC said, “We are collaboratively trying to build a triangle relationship with two vital regulatory bodies which are Bangladesh bank and NBR to promote foreign investment, venture capital and private equity firm in Bangladesh.”

Sami Ahmed, Managing Director, Startup Bangladesh Limited said, “It is an exhilarating time for startup ecosystem in Bangladesh as we see a lot of innovations coming to us for funding. We only read about various innovations those are happening in other countries, but it is really overwhelming to see similar types of ideas and innovations are also nurtured and pitched to us almost every day.”

Asif Mahmood, Vice President, VCPEAB and Managing Director, SEAF Bangladesh Ventures LLC said, “Our education system needs to be transformed in a way so that the younger generation who are the actual producer and nurturer of innovation can be integrated in our startup ecosystem”.

Jenni Risku, Board Member, World Social Innovation Forum (WSIF) and Founder, Women in Tech Conference Asia said, “Women can actually be a catalyst to the entire startup ecosystem. I believe diversity in ecosystem pays back in a number of ways- to the investors, to the startups as well as to the government.”

James Tan, Board Member, World Social Innovation Forum (WSIF) and Managing Partner, Quest Ventures said, “Singapore, one of the world’s leading startup ecosystems in terms of multiple successful startups, is the regional hub for incorporation, venture capital, and international connections. I really think the world stands ready to invest in potential great economies such as Bangladesh.”

Sonia Bashir, Director, VCPEAB and Managing Director, SBK Tech Ventures said, “Being a VC, and women entrepreneur, I think that women entrepreneurs or women VCs need to get more attention. If we consider women as an asset class, cater them, groom them and ensure gender balance, there will be a lot of value addition in this field.”

Fahim Mashroor, CEO, Delivery Tiger; CEO & Co-Founder, AjkerDeal.com; Managing Director, Bdjobs.com said, “We need to be very pragmatic on startup funding that probably we will not be flooded with global VC fund in next 2 to 3 years. So, we need to work on policy level and ensure higher capital efficiency so that we can get maximum output from the funding we get.”

Tanveer Ali, Director, VCPEAB and Chief Investment Officer, Constellation Asset Management Company Ltd said, “Collaboration and empathy can contribute towards better vibrancy in the ecosystem. It is important for each stakeholder to understand the challenge of others and work collaboratively to reach a common goal. The other considerations which are needed to be considered are legal supports, tax exemptions and exit opportunities.”

Ziaur Rahman, President, Capital Market Journalist Forum (CMJF) and Editor, Arthoshuchok said, “Media can play a vital role to attract foreign investment and increase the brand equity of Bangladesh startup ecosystem globally by writing up features, articles and reports on innovations and talented entrepreneurs.”

Carman Chan, Global Steering Committee Member, World Social Innovation Forum (WSIF); Managing Director, Click Ventures (China); Zia U. Ahmed Ph. D, Senior Vice President, VCPEAB, Chairman, VIPB Asset Management Company Ltd; Sajid Rahman, Managing Partner, MyAsiaVC, Board Member, ICANN; Noel Akpata, Global Steering Committee Member, World Social Innovation Forum (WSIF), CEO, Stratex Pro (Nigeria); Shafique-ul-Azam, Vice President, VCPEAB, Managing Director, BD Venture Limited; Shawkat Hossain, Director, VCPEAB, Managing Director, Velocity Asia Ltd; Waseem Alim, Co-Founder & CEO, Chaldal were also present.